Graduating our youth to wealth

A tale as old as time: Graduating high school and immediately signing up for decades of debt (that the signer knows little about). Yet debt, is also one of the top reasons adults don’t address financial priorities. Below, you will see a chart from Annuity displays the percentage of adults in each generation, who do not prioritize any financial priority unrelated to their debt:

Bad time to be a millennial… but a good time for millennial parents in our community! Stick around until the end to find out why.

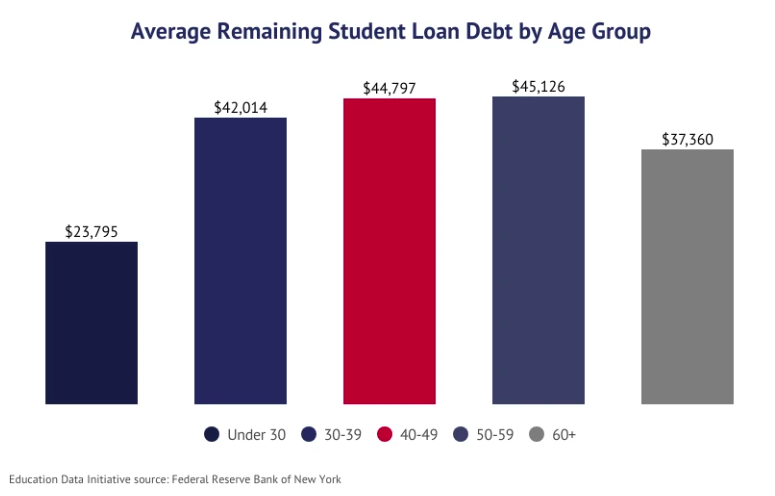

As far as debt goes, the snowball effect can often feel like an avalanche. You might be currently under the avalanche or recalling when you dug yourself out from under it - either way, we are all affected by it and typically, our first encounter is in the form of a massive student loan. The graph below, by the Education Data Initiative, reflects the student loan debt, by age, in 2024:

A financially abundant future would be daunting, with the overhead of $24,000 before you have even begun making use of the education purchased. While student loans may be a necessary evil, we can offer youth a more beneficial outlook on inquiring debt and the management of it thereafter (raise your hand if you have ever been victimized by years of minimum payments).

Not only could we have these conversations with our peers and identify these statistics to be true, we would also be able to identify the snowball effect of debt on individuals mental health, mental health in community and the translation of that into society. A Forbes study published in September 2024, stated the following regarding U.S. adults in debt:

“Due to debt-related stress, 48% reported sleep problems, 40% had higher anxiety, 38% led diminished social lives and 34% experienced depression.”

As we continue to see the decline of mental health and rise of debt, we must fight the core of the issues. La Mesa Juneteenth deeply believes in an equitable future for ALL. In this effort, we are launching our financial literacy program in the fall for eighth graders and their parents.

We believe in our students graduating to wealth, not stress.

For additional information on how to partner with us, and updates regarding our financial literacy program, subscribe to our newsletter.

A $25 donation today, opens a savings account for one eighth grader in our community.